The all-new Uber Pro Card

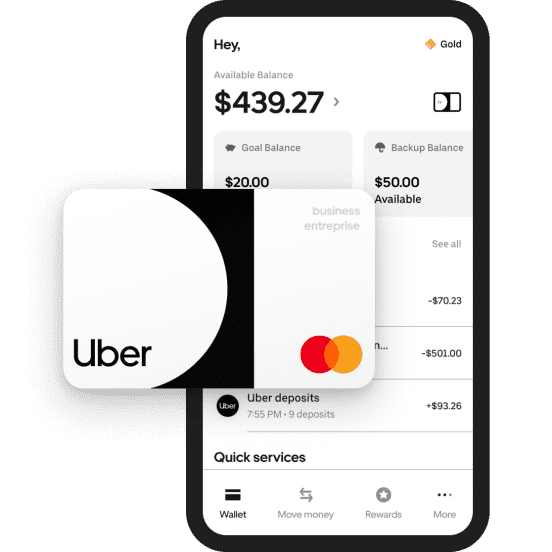

Keep more of what you earn with the Uber Pro Card ¹, powered by Payfare.

Drivers and couriers get cash back on gas and EV Charging,² free automatic payouts after every trip,³ and $50 in Backup Balance.⁴

Worry-free banking

Use your Uber Pro Card wherever you shop, to make purchases online and in-store and while traveling. Secure and flexible banking on the go. Simply log into your Uber Pro Card app to lock your card anytime.

Up to 6% cash back on gas with Diamond status

Get cash back on gas when paying at the pump with your Uber Pro Card at any station, in any city.

The higher your Uber Pro status, the more cash back you can get.⁵

|  Blue (drivers) and Green (couriers) |  Gold |  Platinum |  Diamond |

|---|---|---|---|---|

At any gas pump, in any city | 1% | 2% | 3% | 4% |

Additional cash back on fuel at Esso and Mobil stations | 2% | 2% | 2% | 2% |

Set up your Savings

Stay in control with a Goal account in the Uber Pro Card app, where you can set aside earnings to save for a dream vacation, school, or special gift.

More cash back deals

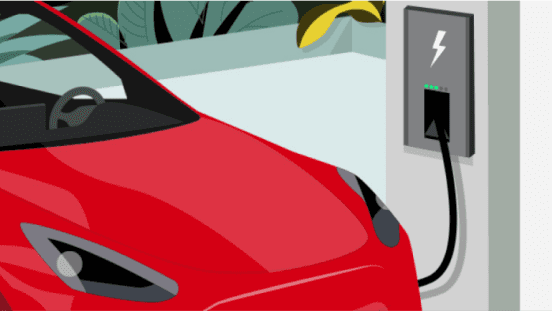

EV charging

Get up to 8% cash back at eligible public charging stations with Diamond status.⁵

Dining

Get cash back at select restaurants, including Panda Express.⁶

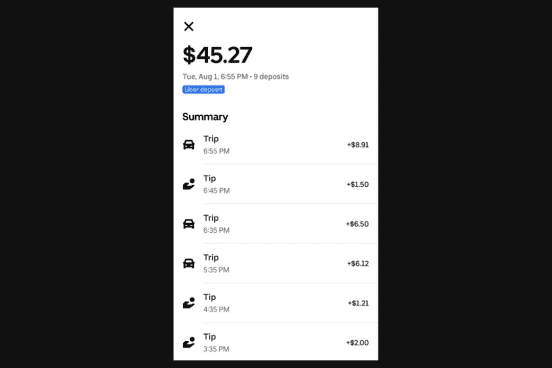

Free, automatic cash out after every trip

Free, automatic cash out after every trip

Earnings go directly to your Uber Pro Card after every trip—free of charge.³ And you can withdraw cash for free at select 4,800+ ATMs across Canada.⁷

Frequently asked questions

- What is the Uber Pro Card?

The Uber Pro Card is a business prepaid Mastercard powered by Payfare, that is designed to help you keep more of what you earn. You can use it to pay for purchases anywhere Mastercard is accepted.

- Who is Uber's program partner for Uber Pro Card?

Uber has partnered with Payfare, a financial technology company. Payfare provides customer support services for the Uber Pro Card and powers the Uber Pro Card app: a digital banking wallet where you can track your earnings, transfer money to other bank accounts, earn rewards, and manage your savings. The Uber Pro Card is issued by Peoples Trust Company. Payfare offers a complete banking solution to drivers and delivery people in Canada who are active on the Driver app.

- Is Payfare a bank?

Payfare is a financial technology company that works to provide secure, instant access to earnings through banking services provided by Peoples Trust Company.

- Is this a debit card or a credit card?

The Uber Pro Card is a prepaid card, so you can do things like make purchases wherever Mastercard is accepted, transfer money to and from other bank accounts, and withdraw funds from nearby free ATMs.

- Does this require a credit check?

No, there’s no credit check. Any driver or delivery person with an Uber Pro status is welcome to apply, and most will be approved within minutes. Government ID verification and supporting documents may be required.

¹The Uber Pro Card is a Mastercard Business Prepaid card issued by Peoples Trust Company under licence from Mastercard® International Incorporated. Mastercard is a registered trademark, and the circles design is a trademark of Mastercard International Incorporated. Subject to eligibility. Limits, terms and conditions apply. May be used everywhere Mastercard cards are accepted. Funds loaded onto the Uber Pro Card are held by the issuer Peoples Trust Company, a member of the Canada Deposit Insurance Corporation (CDIC), and are eligible for CDIC coverage. For more information about CDIC, see Protecting your deposits. Uber is not responsible for the products and/or services offered by other companies, or for the terms and conditions (including financial terms) under which those products and/or services are offered. Trademarks shown are property of their respective owners. Your use of the Uber Pro loyalty program is subject to the Uber Pro Terms and Conditions.

²Up to 6% is available for drivers and couriers with Diamond status who pay with the Uber Pro Card at the pump. For cash back on gas, only payments made at the pump are eligible.

³Automatic cashouts need to be enabled in the Driver app. Delays can happen due to technical issues, but transfers are expected to happen in 1-5 seconds, on average.

⁴Backup Balance is only available to Uber Pro Card users with enabled automatic payouts after every trip. It also requires a minimum of $700 in earnings on the Uber platform in the previous calendar month.

⁵Base cash back benefit is between 1% to 4% for gas purchases and between 2% and 8% for public EV charging, depending on your Uber Pro status. Total cash back you can earn with the Uber Pro Card on refueling (gas or public EV charging) is $100 per month. Reward categories and amounts subject to change without notice. Gas and public EV charging merchant classification is subject to Mastercard rules.

⁶For more information on Mastercard Easy Savings, visit their Terms and Conditions page here.

⁷Find nearby no-fee ATM locations in the Uber Pro Card app. You may incur a fee by withdrawing funds from an out-of-network ATM. Use the ATM Locator within the Uber Pro Card app to ensure that you are using an in-network, no-fee ATM.

About

Explore

Opportunities by city