SPARK! 7 city level data

Written byIn 2020, Uber set bold global commitments on sustainability. We will be a net-zero-emission platform by 2040 worldwide, and we’re targeting 2030 for zero emissions in Europe, the US, and Canada for our mobility platform. Even more ambitiously, we made a unique commitment of an average of 50% zero-emission km’s by 2025 across 7 key European capitals: Amsterdam, Berlin, Brussels, Lisbon, London, Madrid, and Paris.

Below is an update on how we’ve progressed since the beginning of 2020—in total, and individually by city. It’s part of our commitment to be transparent on the progress we’re making and where we’re still experiencing obstacles in this transition.

For additional context on all the work we’re doing to achieve our targets, you can read this Uber newsroom article.

Europe

- Our percentage of kilometres coming from EVs increased 2.5x year on year

- This means uptake of EVs on the Uber platform is 4.6x larger than the general population penetration in these 7 key countries combined

- The number of diesel vehicles active on the platform has reduced by 10 percentage points since H1 2020

- This has combined to reduce our average emissions intensity by 6% to 97.2 gCO2/km

- The majority of this progress has been achieved in Amsterdam, Lisbon, London, and Paris, where we’ve focused our efforts the most over the last year

- It’s still early, but we’re on track to hit our commitment of 50% zero-emission journeys by 2025

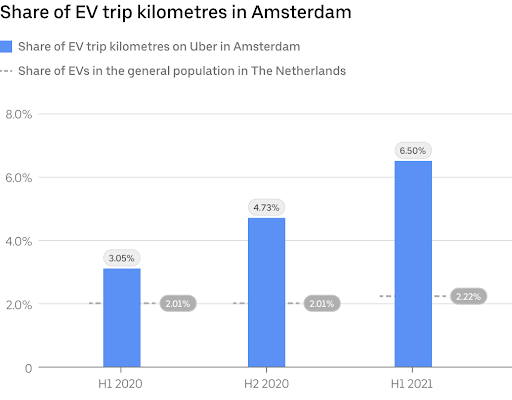

Amsterdam

- Amsterdam is one of Uber’s highest-penetration EV markets in the world, with the percentage of EV kilometres on Uber more than doubling between H1 2020 and H1 2021

- This uptake has been much faster than growth in the general population across The Netherlands; EV penetration on the Uber platform is 3x higher

- Current levels of EV adoption are aided by the widespread availability of residential charging across the city

- This goes a long way to positively influencing drivers’ total cost of ownership, but the relative lack of rapid/destination charging is a potential blocker to further growth

Berlin

- We’ve seen a reduction in the use of EVs on the Uber platform in Berlin since H1 2020

- EVs are now under-penetrated on the Uber platform versus the country’s general population

- This negative trend is due to a heavy demand surge on the platform since Q2, in which partners have tended to deprioritize EV use given their lower efficiency

- This efficiency gap is heavily driven by German “return to garage” legislation, which adds significantly to the number of kilometres required for each trip, making the economic case for transitioning for private hire vehicle (PHV) drivers very difficult

- The majority of kilometres in Berlin are in hybrids (75%); a subset of these with very low emissions are available through Uber Green

- This vehicle mix means that the average emissions per vehicle is 99.3 gCO2/km, which is 8% lower than the average 2020 new vehicle in the EU

Brussels

- Uber has almost no EV penetration in Brussels

- PHV drivers face uncertainty about their future in the Brussels region whilst the current regulations remain in place

- This means making investments in cleaner vehicles is challenging

- Current regulations include car size and price requirements (obligation to buy large and expensive pollutant cars)

- Additionally, the deployment of charging stations in the city remains limited and slows EV adoption

Lisbon

- We have steadily increased the EV supply in Lisbon; the percentage of kilometres that EV represents is now considerably ahead of the general population share in Portugal

- This momentum is partly possible because of the packaged deal that we’ve launched with Nissan, PowerDot, and LeasePlan to reduce the total cost of ownership

- In 2021, the Portuguese government’s incentive was redirected exclusively to the purchase of commercial vehicles, excluding light passenger vehicles (VAT, road, and car registration taxes are still exempt for EVs)

London

- London, our biggest market in Europe, has seen a 3.5x increase in EV kilometres as a percentage of all kilometres driven in the past year

- That means that EV uptake on the Uber platform in London is almost 8x higher than in the general population in the UK

- Given the growth of EVs and the prominence of hybrids in London, the average CO2 emissions per kilometre on the Uber platform in the city is now at 91.9, which is 19% below emissions from average new vehicles in the UK in 2020

- The London Clean Air Plan, launched in 2019, has raised over £140 million to support drivers with the cost of switching, with the average driver claiming over £2,500 in support

- In addition, drivers benefit from specially negotiated rates or access from all the major EV manufacturers and from our partnership with BP Pulse, which runs the UK’s largest network of rapid chargers

- This rapid acceleration is aided significantly by a strong regulatory environment, including EVs being exempt from the daily congestion charge (£15) and the requirement that newly licensed PHVs are zero-emission capable

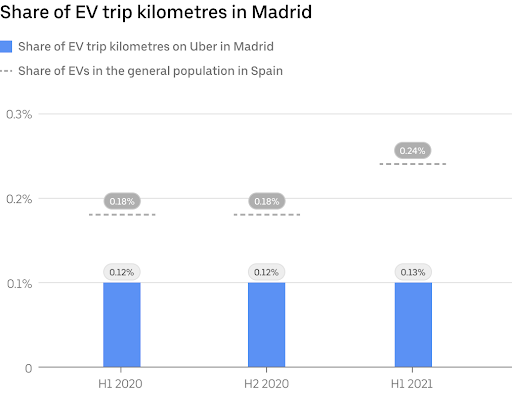

Madrid

- Overall EV penetration is low in the Spanish market versus other European countries and regions

- Uber’s EV numbers in Madrid are growing gradually, leading to a small increase in EV kilometres as a percent of the total but from a very low base and still below overall market penetration rates

- We’re ambitious about accelerating progress over the next year as we bring together new partnerships that should reduce the total cost of ownership for drivers

- This should allow us to launch Uber Green in Madrid in early 2022

- The national government currently has an EV purchase incentive of up to €7,000 (Plan Moves III) eligible for PHVs and taxis

Paris

- We’ve seen significant increases (over 2x) in EV kilometres in Paris since H1 2020

- This has helped us almost reach parity in penetration rate on the Uber platform in Paris and in the general population in France

- Drivers have accumulated funds as part of Uber’s Electric Mobility Plan in France, and the first cohorts are expected to claim EV assistance in H2 2021

- Significant focus has been on reducing the percentage of kilometres that are accounted for by diesel vehicles; this has dropped by 15 percentage points since H1 2020

- This has contributed to a drop in average emissions rating of 5%

- We’re also supporting this transition through creating a network of partnerships across major vehicle suppliers and EV charging operators, such as Renault-Nissan and TotalEnergies

- From January 2022, no new diesel vehicles will be onboarded to the platform as part of a progressive milestone towards zero diesel in 2024 commitment in France